What Does Drip Stand for in Finance

DRIP stands for Dividend Reinvestment Plan. When an investor is enrolled in DRIP stocks, it means that incoming dividend payments are used to purchase more shares of the issuing company – automatically.

Many businesses offer DRIPs that require the investors to pay fees. Obviously, paying fees is a negative for investors. As a general rule, investors are better off avoiding DRIP stocks that charge fees.

Fortunately, many companies offer no-fee DRIP stocks. These allow investors to use their hard-earned dividends to build even larger positions in their favorite high-quality, dividend-paying companies – for free.

Dividend Aristocrats are the perfect form of DRIP stocks. Dividend Aristocrats are elite companies that satisfy the following:

You can download an Excel spreadsheet with the full list of all 65 Dividend Aristocrats (with additional financial metrics such as price-to-earnings ratios and dividend yields) by clicking the link below:

You are reinvesting dividends into a company that pays higher dividends every year. This means that every year you get more shares – and each share is paying you more dividend income than the previous year.

This makes a powerful (and cost-effective) compounding machine.

This article takes a look at the top 15 Dividend Aristocrats that are no-fee DRIP stocks, ranked in order of expected total returns from lowest to highest.

The updated list for 2021 includes our top 15 Dividend Aristocrats, ranked by expected returns according to the Sure Analysis Research Database, that offer no-fee DRIPs to shareholders. You can skip to analysis of any individual Dividend Aristocrat below:

Additionally, please see the video below for more coverage.

Federal Realty was founded in 1962. As a Real Estate Investment Trust, Federal Realty's business model is to own and rent out real estate properties. It uses a significant portion of its rental income, as well as external financing, to acquire new properties. This helps create a "snow-ball" effect of rising income over time.

Federal Realty primarily owns shopping centers. However, it also operates in redevelopment of multi-purpose properties including retail, apartments, and condominiums. The portfolio is highly diversified in terms of tenant base. Federal Realty has a high-quality tenant portfolio.

However, shares appear significantly overvalued, with a 2021 P/FFO ratio of 26, compared with our fair value estimate of 15. Even with the 3.5% dividend yield and 6.3% expected FFO-per-share growth per year, we expect total returns of 0.1% per year.

Sherwin-Williams, founded in 1866 and headquartered in Cleveland, OH, is North America's largest manufacturer of paints and coatings. The company distributes its products through wholesalers as well as retail stores (including a chain of more than 4,900 company-operated stores and facilities) to 120 countries under the Sherwin-Williams name.

The company also manufactures Dutch Boy, Pratt & Lambert, Minwax, Thompson's Waterseal, Krylon, Valspar (acquired in 2017), and other brands.

The stock trades for more than 30 times earnings. We believe shares are significantly overvalued today. The combination of valuation changes, 8% annual EPS growth, and the 0.7% dividend yield result in expected annual returns of 0.5% per year.

Abbott Laboratories is one of the largest medical appliances & equipment manufacturers in the world, comprised of four segments: Nutrition, Diagnostics, Established Pharmaceuticals and Medical Devices.

Abbott has increased its dividend for 49 years, including its impressive 25% dividend increase in December 2020. Abbott has a large and diversified product portfolio, with leadership across multiple categories.

With a P/E of 25, Abbott appears overvalued. Our fair value estimate is a P/E of 20. Overvaluation could significantly weigh on shareholder returns going forward.

Expected EPS growth of 4% per year plus the 1.4% dividend yield will offset the impact of a declining P/E multiple, but total returns are expected at just 1.1% per year over the next five years.

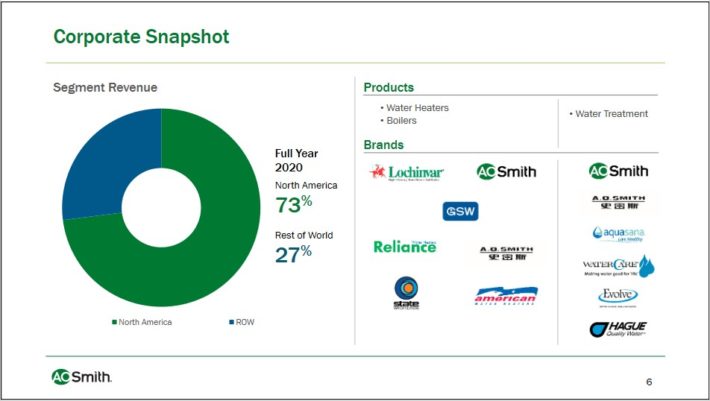

A.O. Smith is a leading manufacturer of residential and commercial water heaters, boilers and water treatment products. A.O. Smith generates the majority of its sales in North America, with the remainder from the rest of the world. It has category-leading brands across its various geographic markets.

The company is perhaps best-known for its water heaters. It operates in two operating segments, separated by geography:

Source: Investor Presentation

As you can see, the company has a sizable international presence.

A.O. Smith has raised its dividend for 27 years in a row, including an ~8% increase in October 2021.

Over the long-term, we believe that A.O. Smith can grow its EPS by 6% per year. With a 1.7% dividend yield and annual dividend increases, A.O. Smith is an appealing stock for dividend growth investors.

However, we believe the stock is overvalued right now, and we expect 1.7% annual returns through 2026. Therefore, we rate AOS a sell on valuation concerns.

Click here to download our most recent Sure Analysis report on A.O. Smith (preview of page 1 of 3 shown below):

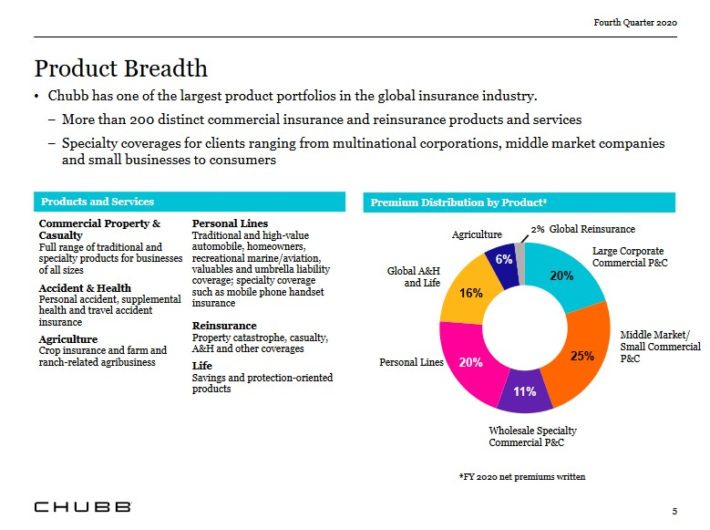

No-Fee DRIP Dividend Aristocrat #11: Chubb Limited (CB)

Chubb Ltd is a global provider of insurance and reinsurance services headquartered in Zurich, Switzerland. The company provides insurance services including property & casualty insurance, accident & health insurance, life insurance, and reinsurance. The current version of Chubb was created in 2016, when Ace Limited acquired the 'old' Chubb and adopted its name.

Chubb has a large and diversified product portfolio.

Source: Investor Presentation

Shares trade for a price-to-book ratio of 1.2, which is above our fair value estimate of 1.05. Meanwhile, expected book-value-per-share growth of 5% and the 1.7% dividend yield lead to total expected returns of 2.1% per year through 2026.

Click here to download our most recent Sure Analysis report on Chubb (preview of page 1 of 3 shown below):

No-Fee DRIP Dividend Aristocrat #10: S&P Global Inc. (SPGI)

S&P Global is a worldwide provider of financial services and business information with revenue of nearly $8 billion. It generates about half of its operating income from its ratings segment, 30% from market and commodities intelligence and the balance from S&P Dow Jones Indices. S&P Global's revenue is split roughly 55/45 between US and International, respectively.

S&P Global has paid dividends since 1937 and has increased its payout for 48 years.

We expect 7% annual EPS growth over the next five years. The stock has a low dividend yield of 0.8%, but raises its dividend at a high rate. We estimate total return potential at 2.3% per year over the next five years.

Click here to download our most recent Sure Analysis report on S&P Global (preview of page 1 of 3 shown below):

No-Fee DRIP Dividend Aristocrat #9: Illinois Tool Works (ITW)

Illinois Tool Works is a diversified multi-industrial manufacturer with seven unique operating segments: Automotive, Food Equipment, Test & Measurement, Welding, Polymers & Fluids, Construction Products and Specialty Products.

Shares trade for a P/E of nearly 30, above our fair value P/E estimate of 19. Expected EPS growth of 7% per year and the 2.2% dividend yield will offset the impact of overvaluation, leading to expected returns of 2.4% per year over the next five years.

Click here to download our most recent Sure Analysis report on Illinois Tool Works (preview of page 1 of 3 shown below):

No-Fee DRIP Dividend Aristocrat #8: Emerson Electric (EMR)

Emerson Electric is an ideal candidate for a no-fee DRIP program, as the company has increased its dividend for over 60 years in a row. Emerson Electric was founded in Missouri in 1890. Today, Its global customer base affords it $18+ billion in annual revenue.

Emerson is organized into two major reporting segments called Automation Solutions and Commercial & Residential Solutions. Automation Solutions helps manufacturers minimize energy usage, waste, and other costs in their processes. The Commercial & Residential Solutions segment makes products that protect food quality and safety, as well as boost efficiency in the production process.

A declining P/E multiple to the fair value estimate could reduce annual returns. We also expect annual EPS growth of 6%, and Emerson stock has a 2.1% dividend yield. Overall, we expect total returns of 3.6% per year through 2026.

Click here to download our most recent Sure Analysis report on Emerson Electric (preview of page 1 of 3 shown below):

No-Fee DRIP Dividend Aristocrat #7: Exxon Mobil (XOM)

Exxon Mobil is an integrated super-major, with operations across the oil and gas industry. It derives the majority of its earnings from its upstream segment, with the remainder from its downstream (mostly refining) segment and its chemicals segment.

Exxon Mobil is a high dividend stock with a 5.4% yield. It is the highest yield among the DRIP stocks.

Including the 5.4% dividend yield, 6% annual EPS growth, and a significant negative impact from a declining P/E multiple, we expect total annual returns of 4.6% per year over the next five years. Exxon Mobil is a riskier Dividend Aristocrat due to its volatile industry.

Click here to download our most recent Sure Analysis report on Exxon Mobil (preview of page 1 of 3 shown below):

No-Fee DRIP Dividend Aristocrat #6: Hormel Foods (HRL)

Hormel Foods was founded back in 1891 in Minnesota. Since that time, the company has grown into a juggernaut in the food products industry with nearly $10 billion in annual revenue. Hormel has kept with its core competency as a processor of meat products for well over a hundred years, but has also grown into other business lines through acquisitions.

Hormel has a large portfolio of category-leading brands. Just a few of its top brands include include Skippy, SPAM, Applegate, Justin's, and more than 30 others.

Source: Investor Presentation

Hormel stock appears overvalued, trading for 25 times this year's EPS estimate. We expect 5% annual EPS growth, while the stock has a 2.1% dividend yield. Overall, we expect annual returns of 4.8% per year through 2026.

Click here to download our most recent Sure Analysis report on Hormel (preview of page 1 of 3 shown below):

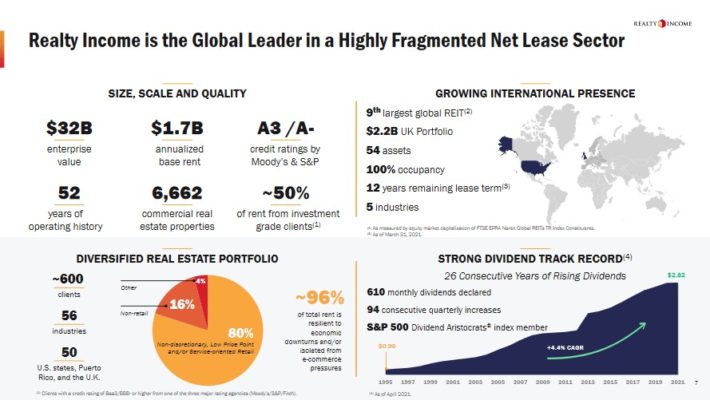

No-Fee DRIP Dividend Aristocrat #5: Realty Income (O)

Realty Income is a retail-focused REIT that owns more than 6,500 properties. It owns retail properties that are not part of a wider retail development (such as a mall), but instead are standalone properties. This means that the properties are viable for many different tenants, including government services, healthcare services, and entertainment.

The company's long history of dividend payments and increases is due to its high-quality business model and diversified property portfolio.

Source: Investor Presentation

The stock trades for a P/FFO ratio of 20.9, based on our estimate of $3.56 for 2021 FFO-per-share. Our fair value estimate is a P/FFO ratio of 18, which means the stock appears to be overvalued.

Offsetting the valuation headwind will be expected FFO-per-share growth of 4.0% and the current dividend yield of 3.8% leading to total expected returns of about 5% per year.

Click here to download our most recent Sure Analysis report on Realty Income (preview of page 1 of 3 shown below):

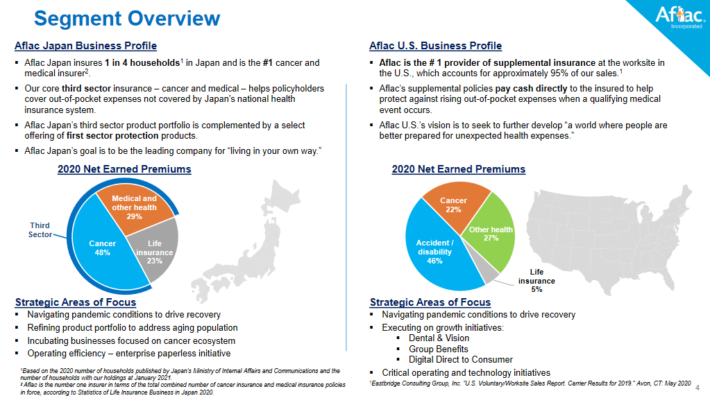

No-Fee DRIP Dividend Aristocrat #4: Aflac Inc. (AFL)

Aflac was formed in 1955, when three brothers — John, Paul, and Bill Amos — came up with the idea to sell insurance products that paid cash if a policyholder got sick or injured. In the mid-20th century, workplace injuries were common, with no insurance product at the time to cover this risk.

Related: Detailed analysis on the best insurance stocks.

Today, Aflac has a wide range of product offerings, some of which include accident, short-term disability, critical illness, hospital indemnity, dental, vision, and life insurance.

Source: Investor Presentation

The company specializes in supplemental insurance, which pays out to policy holders if they are sick or injured, and cannot work. Aflac operates in the U.S. and Japan, with Japan accounting for approximately 70% of the company's revenue. Because of this, investors are exposed to currency risk.

In general terms, Aflac has two sources of income: income from premiums and income from investments. Taking the items collectively, in addition to an active share repurchase program, reasonable expectations would be for 4% annual earnings-per-share growth over the next five years.

However, we believe the stock is slightly overvalued right now, which will reduce shareholder returns. In addition, the current dividend yield of 2.3%, leads to total expected returns of 5.8% per year.

Click here to download our most recent Sure Analysis report on Aflac (preview of page 1 of 3 shown below):

No-Fee DRIP Dividend Aristocrat #3: 3M Company (MMM)

3M is a diversified global industrial manufacturer. It manufactures ~60,000 products, which are sold in 200 countries around the world. 3M came to dominate the industrial manufacturing industry through a sharp focus on the most attractive market segments.

3M has increased its dividend for over 60 consecutive years. It is on the exclusive list of Dividend Kings, a group of stocks with 50+ consecutive years of dividend growth. You can see all 32 Dividend Kings here.

3M is slightly undervalued right row, with a P/E ratio of 18.5, compared with our fair value P/E of 19. Returns will be boosted by 5% annual EPS growth and the 3.2% dividend yield. Overall, we expect annual returns of 5.8% per year for 3M over the next five years.

Click here to download our most recent Sure Analysis report on 3M (preview of page 1 of 3 shown below):

No-Fee DRIP Dividend Aristocrat #2: Johnson & Johnson (JNJ)

Johnson & Johnson is a global healthcare giant. It has a market capitalization above $400 billion, and generates annual revenue of more than $81 billion. Today, J&J manufactures and sells health care products through three main segments:

- Pharmaceuticals

- Medical Devices

- Consumer Health Products

J&J has increased its dividend for 58 consecutive years, making it a Dividend King.

The stock yields 2.6% right now. In addition, we expect approximately 6% annual earnings-per-share growth over the next five years.

Lastly, the stock has a P/E of 17.5, slightly above our fair value P/E estimate of 17. All together, we expect total returns of 8.7% per year for J&J stock.

Click here to download our most recent Sure Analysis report on J&J (preview of page 1 of 3 shown below):

No-Fee DRIP Dividend Aristocrat #1: AbbVie Inc. (ABBV)

AbbVie Inc. is a pharmaceutical company spun off by Abbott Laboratories (ABT) in 2013. Its most important product is Humira, which is now facing biosimilar competition in Europe, which has had a noticeable impact on the company. Humira will lose patent protection in the U.S. in 2023.

Even so, AbbVie remains a giant in the healthcare sector, with a large and diversified product portfolio.

Source: Investor Presentation

Based on expected 2021 earnings-per-share of $12.47, AbbVie trades for a price-to-earnings ratio of ~8.7. Our fair value estimate for AbbVie is a price-to-earnings ratio (P/E) of 10. An expanding P/E multiple could boost shareholder returns over the next five years.

In addition, we expect annual earnings growth of 3.0%, while the stock has a 4.8% dividend yield. AbbVie is among the higher-yielding DRIP stocks. We expect total annual returns of 10.2% per year over the next five years.

Click here to download our most recent Sure Analysis report on AbbVie (preview of page 1 of 3 shown below):

Final Thoughts and Additional Resources

Enrolling in DRIP stocks can be a great way to compound your portfolio income over time.

Additional resources are listed below for investors interested in further research for DRIP stocks.

- List of no-fee DRIPs

For dividend growth investors interested in DRIP stocks, the 15 companies mentioned in this article are a great place to start. Each business is very shareholder friendly, as evidenced by their long dividend histories and their willingness to offer investors no-fee DRIP stocks.

What Does Drip Stand for in Finance

Source: https://www.suredividend.com/best-drip-stocks/

0 Response to "What Does Drip Stand for in Finance"

Post a Comment